B5.4 Utility tax

Develop a local utility charge to fund clean energy projects

Private utility taxes

RCW 35.21.870 limits the utility tax on electricity, natural gas, and telephone service to 6%, unless voters approve a higher level.

Olympia’s 9% tax includes a 3% surcharge for parks and pathways approved by voters in 2004. Its tax for cable TV service is still 6%.

Tumwater taxes the private utilities at 6%. (Increasing this by 1% would raise roughly $500,000.)

Lacey taxes the private utilities at 6%.

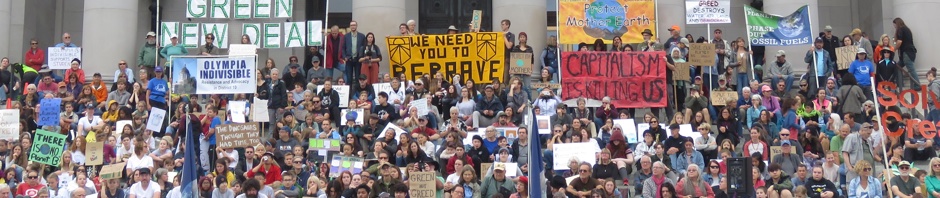

Boulder voters passed a tax on electricity to fund local climate action, and then extended it. Activists in Denver began collecting signatures in May 2019 to put a tax on energy use by businesses on the ballot there; they were unsuccessful; the City Council and the Mayor debated adopting a similar proposal, but compromised on some small steps and studying a tax further.

Public utility taxes

Taxes on public utilities may be raised by the jurisdictions without voters’ approval.

Olympia taxes drinking water at 12%, and its other municipal utilities at 10%.

Tumwater taxes its municipal utilities at 6%. (Increasing this by 1% would raise roughly $150,000.)

I think Lacey taxes drinking water at 12.04%, and its other municipal utilities at 6%.

Thurston County only supplies water and sewer to about 800 residents.

Franchise fees

RCW 35.21.860 limits franchise fees to recovering expenses “directly related to receiving and approving a permit, license, and franchise, to inspecting plans and construction, or to the preparation of environmental impact statements.